Procurement 101: Category Management – From siloed optimization to company-wide excellence

Table of Contents

Category management is a method designed to elevate procurement activities, which often become optimized for individual departments, towards optimization for the entire company. It begins by broadly categorizing purchase items based on accounts or similar classifications, such as mechanical parts, electronic components, and off-the-shelf goods.

Understanding category management

Category management involves developing procurement strategies for each of these categories, contrasting with item-by-item management where a vendor is sought for each product to negotiate the lowest prices. This item-by-item approach is inefficient when dealing with a wide range of products because it can lead to increased costs for other items, negating any savings achieved.

The process of obtaining quotes and negotiating prices for each item individually is time-consuming and labor-intensive, and it can be even more complicated when each department conducts its own procurement. This often results in one department purchasing similar goods at a higher price than another, which is not cost-effective on a company-wide scale.

Category management addresses these issues by consolidating the procurement process. For example, in the case of fabricated metal parts, it involves understanding the total expenditure and items purchased across buyers, departments, countries, items, and suppliers, and then negotiating prices and quotes on this aggregated basis.

This approach may lead to price increases for some items and decreases for others, but the focus is on reducing costs across the entire category of office supplies. By identifying suppliers who can offer competitive prices for the entire category, not just individual items, companies can leverage stronger buying power and reduce the number of suppliers, leading to preferred supplier agreements.

This method allows for a more strategic procurement process that not only simplifies supplier management but also ensures that the company secures the best possible deals, optimizing overall costs rather than focusing on the cost of individual items.

Key tactics in category management

The implementation of category management involves several key strategies such as supplier segmentation and demand management.

Supplier segmentation

It categorizes suppliers based on their strategic importance and potential value to the organization. This enables targeted supplier management plans and resource allocation, significantly improving the efficiency and effectiveness of procurement activities. A study by McKinsey highlighted that companies with better supplier segmentation could raise profit margins on addressable categories by 10 to 20%.

The Kraljic Matrix offers a strategic framework for the supplier segmentation. It aids organizations in classifying their procurement items based on two key dimensions: the complexity of the market and the importance of each item to the business. This classification results in a four-quadrant matrix that segments items into non-critical, leverage, bottleneck, and strategic categories.

Each of these quadrants dictates a specific procurement strategy:

- Non-critical items, which are low in complexity and importance, call for efficient processing and standardization.

- Leverage items are significant to the business but face lower market complexity, suggesting bulk buying or volume discounts as viable strategies.

- Bottleneck items present high complexity with lower business importance, necessitating diversification of supply sources to mitigate risk.

- Strategic items are both highly important and market-complex, requiring strong supplier relationships and thorough market analysis for risk management and securing supply.

The matrix typically advocates for each segment as below:

Non-critical Items: The focus here is on efficiency and minimizing the administrative burden. Strategies like e-auctioning and the use of catalogs can help streamline the procurement process, making it easier to manage these items without consuming significant resources.

Leverage Items: Buyers have significant power and can use it to negotiate better terms or foster innovation from suppliers. The abundance of interchangeable suppliers in this market means buyers can push for lower prices, though they must be wary of pushing too hard and jeopardizing supplier viability.

Bottleneck Items: The strategy focuses on damage limitation, recognizing the limited opportunities for favorable deals. Creative procurement strategies may include redefining product requirements to substitute materials from more accessible sources, thereby mitigating the risk.

Strategic Items: Effective management involves a broad skill set and significant executive involvement to nurture a collaborative, mutually beneficial relationship. This partnership is crucial for ensuring supply chain reliability and fostering innovation.

Demand management

It focuses on understanding and forecasting future requirements, optimizing inventory levels, and aligning procurement with consumer demand by implementing the following techniques:

Analyzing Historical Data: This foundational approach leverages past sales, trends, and customer behaviors to predict future demand. It empowers procurement teams to refine inventory strategies, fulfilling customer needs while optimizing stock levels.

Market Analysis: By scrutinizing current market trends, customer preferences, and the competitive environment, organizations gain qualitative insights that complement data-driven forecasts. This method adjusts predictions based on evolving market conditions and consumer shifts, enriching the forecasting accuracy.

Statistical Forecasting: Utilizing mathematical models, statistical forecasting analyzes historical sales data to identify patterns. This technique incorporates seasonal changes and economic factors, offering a sophisticated tool for projecting future demand.

Collaborative Stakeholder Engagement: Integral to demand management, this strategy involves key internal stakeholders—like sales, marketing, and operations—in forecasting discussions. The collaboration results in a unified demand management plan that encapsulates diverse departmental insights, ensuring comprehensive and accurate demand forecasts.

Sales and Operations Planning (S&OP): S&OP facilitates regular collaboration between various departments to align demand forecasts with operational strategies. This process ensures that production and procurement plans are in sync with market demand, enhancing organizational efficiency.

Continuous Review and Adjustment: Demand planning is an ongoing process that requires regular updates to forecasts as new information emerges and market conditions change. This agility allows organizations to maintain relevant and precise demand plans, swiftly adapting to market fluctuations or supply chain disruptions.

By implementing these demand management techniques, you can minimize wasteful spending and reduce stockouts, ensuring that manufacturing operations are both efficient and responsive to market needs.

Category management as the sore of strategic sourcing

Strategic sourcing is not a concept that stands in direct comparison with category management; rather, it encompasses category management as part of its broader strategy.

It helps identify the most suitable suppliers, negotiate favorable contracts, and establish robust supplier performance metrics. This approach not only ensures that manufacturing operations are supported by reliable and cost-effective supply chains but also drives continuous improvement in supplier relationships and procurement processes.

This means that category management is a vital tool to make the strategic sourcing initiatives work effectively.

Challenges and best practices in category management

Implementing and executing category management successfully can be challenging, with various obstacles and bottlenecks that organizations need to navigate. One of the primary difficulties lies in the creation and execution of category strategies, which involve comprehensive data collection, analysis, planning, and the implementation of actions. However, this process is often more complex than anticipated.

A significant hurdle is the lack of in-depth insights into spend and supplier data, exacerbated by operating environments characterized by multiple ERPs and other solutions, leading to dispersed and non-harmonized spend data. This situation requires considerable time and manual effort to establish a baseline for spend and supplier information for a given category.

Moreover, a talent gap and rising expectations for category managers present another challenge. Many organizations lack the necessary capabilities or tools to uncover valuable category insights. Category managers often depend on a limited set of strategies focused on basic contract terms and price-increase avoidance, which can limit the achievement of broader outcomes.

The complexity of managing these strategies increases as organizations aim to move beyond siloed optimizations to achieve company-wide excellence. The role of category managers needs to be reimagined, requiring a more analytical and commercially savvy approach, centered around customer needs and the willingness to pay. This shift necessitates a deep understanding of product offerings, pricing, channels, and cost drivers, with a focus on developing a growth-centered product portfolio while expanding margins.

Addressing these challenges involves significant change management, requiring organizations to introduce and implement a uniform process and a common set of tools for category management systematically. This not only involves the category teams but also requires a shift in mindset across stakeholders.

How CADDi Drawer can enables company-wide procurement analysis and process improvement

It has become essential to have solutions that can aggregate and link data from multiple sources, such as ERPs, for processing and analysis to tackle these challenges within limited time and resources. Additionally, solutions that can instantly categorize drawings and design information according to the required perspectives are crucial.

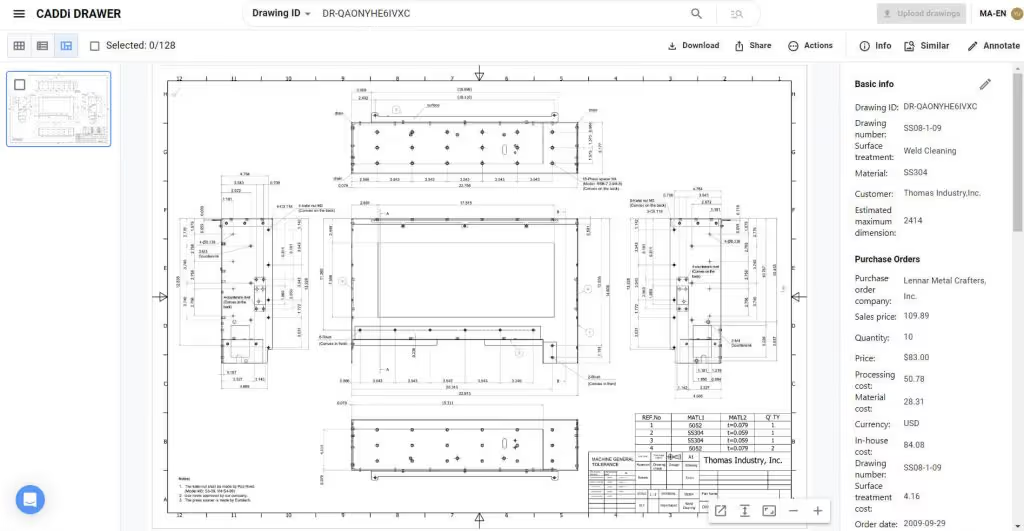

CADDi Drawer is one such solution. Using CADDi Drawer, the following analyses and data management tasks can be easily performed:

Similarity search of part drawings

The similarity search feature enables categorization not only by basic drawing information such as material but also by part shape. This is something that cannot be easily achieved with standard drawing management systems or PDM/PLM software.

Streamline activities in the procurement process

The following features enable you to streamline the time-consuming tasks of data collection and organization in procurement operations.

- Price data and supplier information can be automatically linked to each drawing and can also be exported together.

- By using keyword searches combined with similarity searches, the time spent searching for drawings and data in procurement tasks can be reduced.

Manufacturers of industrial machinery and equipment, such as Kawasaki Railcar Manufacturing, are actually utilizing these features of CADDi Drawer to successfully implement and elevate category management.

Category management is a method designed to elevate procurement activities, which often become optimized for individual departments, towards optimization for the entire company. It begins by broadly categorizing purchase items based on accounts or similar classifications, such as mechanical parts, electronic components, and off-the-shelf goods.

Understanding category management

Category management involves developing procurement strategies for each of these categories, contrasting with item-by-item management where a vendor is sought for each product to negotiate the lowest prices. This item-by-item approach is inefficient when dealing with a wide range of products because it can lead to increased costs for other items, negating any savings achieved.

The process of obtaining quotes and negotiating prices for each item individually is time-consuming and labor-intensive, and it can be even more complicated when each department conducts its own procurement. This often results in one department purchasing similar goods at a higher price than another, which is not cost-effective on a company-wide scale.

Category management addresses these issues by consolidating the procurement process. For example, in the case of fabricated metal parts, it involves understanding the total expenditure and items purchased across buyers, departments, countries, items, and suppliers, and then negotiating prices and quotes on this aggregated basis.

This approach may lead to price increases for some items and decreases for others, but the focus is on reducing costs across the entire category of office supplies. By identifying suppliers who can offer competitive prices for the entire category, not just individual items, companies can leverage stronger buying power and reduce the number of suppliers, leading to preferred supplier agreements.

This method allows for a more strategic procurement process that not only simplifies supplier management but also ensures that the company secures the best possible deals, optimizing overall costs rather than focusing on the cost of individual items.

Key tactics in category management

The implementation of category management involves several key strategies such as supplier segmentation and demand management.

Supplier segmentation

It categorizes suppliers based on their strategic importance and potential value to the organization. This enables targeted supplier management plans and resource allocation, significantly improving the efficiency and effectiveness of procurement activities. A study by McKinsey highlighted that companies with better supplier segmentation could raise profit margins on addressable categories by 10 to 20%.

The Kraljic Matrix offers a strategic framework for the supplier segmentation. It aids organizations in classifying their procurement items based on two key dimensions: the complexity of the market and the importance of each item to the business. This classification results in a four-quadrant matrix that segments items into non-critical, leverage, bottleneck, and strategic categories.

Each of these quadrants dictates a specific procurement strategy:

- Non-critical items, which are low in complexity and importance, call for efficient processing and standardization.

- Leverage items are significant to the business but face lower market complexity, suggesting bulk buying or volume discounts as viable strategies.

- Bottleneck items present high complexity with lower business importance, necessitating diversification of supply sources to mitigate risk.

- Strategic items are both highly important and market-complex, requiring strong supplier relationships and thorough market analysis for risk management and securing supply.

The matrix typically advocates for each segment as below:

Non-critical Items: The focus here is on efficiency and minimizing the administrative burden. Strategies like e-auctioning and the use of catalogs can help streamline the procurement process, making it easier to manage these items without consuming significant resources.

Leverage Items: Buyers have significant power and can use it to negotiate better terms or foster innovation from suppliers. The abundance of interchangeable suppliers in this market means buyers can push for lower prices, though they must be wary of pushing too hard and jeopardizing supplier viability.

Bottleneck Items: The strategy focuses on damage limitation, recognizing the limited opportunities for favorable deals. Creative procurement strategies may include redefining product requirements to substitute materials from more accessible sources, thereby mitigating the risk.

Strategic Items: Effective management involves a broad skill set and significant executive involvement to nurture a collaborative, mutually beneficial relationship. This partnership is crucial for ensuring supply chain reliability and fostering innovation.

Demand management

It focuses on understanding and forecasting future requirements, optimizing inventory levels, and aligning procurement with consumer demand by implementing the following techniques:

Analyzing Historical Data: This foundational approach leverages past sales, trends, and customer behaviors to predict future demand. It empowers procurement teams to refine inventory strategies, fulfilling customer needs while optimizing stock levels.

Market Analysis: By scrutinizing current market trends, customer preferences, and the competitive environment, organizations gain qualitative insights that complement data-driven forecasts. This method adjusts predictions based on evolving market conditions and consumer shifts, enriching the forecasting accuracy.

Statistical Forecasting: Utilizing mathematical models, statistical forecasting analyzes historical sales data to identify patterns. This technique incorporates seasonal changes and economic factors, offering a sophisticated tool for projecting future demand.

Collaborative Stakeholder Engagement: Integral to demand management, this strategy involves key internal stakeholders—like sales, marketing, and operations—in forecasting discussions. The collaboration results in a unified demand management plan that encapsulates diverse departmental insights, ensuring comprehensive and accurate demand forecasts.

Sales and Operations Planning (S&OP): S&OP facilitates regular collaboration between various departments to align demand forecasts with operational strategies. This process ensures that production and procurement plans are in sync with market demand, enhancing organizational efficiency.

Continuous Review and Adjustment: Demand planning is an ongoing process that requires regular updates to forecasts as new information emerges and market conditions change. This agility allows organizations to maintain relevant and precise demand plans, swiftly adapting to market fluctuations or supply chain disruptions.

By implementing these demand management techniques, you can minimize wasteful spending and reduce stockouts, ensuring that manufacturing operations are both efficient and responsive to market needs.

Category management as the sore of strategic sourcing

Strategic sourcing is not a concept that stands in direct comparison with category management; rather, it encompasses category management as part of its broader strategy.

It helps identify the most suitable suppliers, negotiate favorable contracts, and establish robust supplier performance metrics. This approach not only ensures that manufacturing operations are supported by reliable and cost-effective supply chains but also drives continuous improvement in supplier relationships and procurement processes.

This means that category management is a vital tool to make the strategic sourcing initiatives work effectively.

Challenges and best practices in category management

Implementing and executing category management successfully can be challenging, with various obstacles and bottlenecks that organizations need to navigate. One of the primary difficulties lies in the creation and execution of category strategies, which involve comprehensive data collection, analysis, planning, and the implementation of actions. However, this process is often more complex than anticipated.

A significant hurdle is the lack of in-depth insights into spend and supplier data, exacerbated by operating environments characterized by multiple ERPs and other solutions, leading to dispersed and non-harmonized spend data. This situation requires considerable time and manual effort to establish a baseline for spend and supplier information for a given category.

Moreover, a talent gap and rising expectations for category managers present another challenge. Many organizations lack the necessary capabilities or tools to uncover valuable category insights. Category managers often depend on a limited set of strategies focused on basic contract terms and price-increase avoidance, which can limit the achievement of broader outcomes.

The complexity of managing these strategies increases as organizations aim to move beyond siloed optimizations to achieve company-wide excellence. The role of category managers needs to be reimagined, requiring a more analytical and commercially savvy approach, centered around customer needs and the willingness to pay. This shift necessitates a deep understanding of product offerings, pricing, channels, and cost drivers, with a focus on developing a growth-centered product portfolio while expanding margins.

Addressing these challenges involves significant change management, requiring organizations to introduce and implement a uniform process and a common set of tools for category management systematically. This not only involves the category teams but also requires a shift in mindset across stakeholders.

How CADDi Drawer can enables company-wide procurement analysis and process improvement

It has become essential to have solutions that can aggregate and link data from multiple sources, such as ERPs, for processing and analysis to tackle these challenges within limited time and resources. Additionally, solutions that can instantly categorize drawings and design information according to the required perspectives are crucial.

CADDi Drawer is one such solution. Using CADDi Drawer, the following analyses and data management tasks can be easily performed:

Similarity search of part drawings

The similarity search feature enables categorization not only by basic drawing information such as material but also by part shape. This is something that cannot be easily achieved with standard drawing management systems or PDM/PLM software.

Streamline activities in the procurement process

The following features enable you to streamline the time-consuming tasks of data collection and organization in procurement operations.

- Price data and supplier information can be automatically linked to each drawing and can also be exported together.

- By using keyword searches combined with similarity searches, the time spent searching for drawings and data in procurement tasks can be reduced.

Manufacturers of industrial machinery and equipment, such as Kawasaki Railcar Manufacturing, are actually utilizing these features of CADDi Drawer to successfully implement and elevate category management.

Ready to see CADDi Drawer in action? Get a personalized demo.

Subscribe to our Blog!

Related Resources

.svg)

.svg)

.svg)

.svg)